In today's financial landscape, many individuals find themselves facing obstacles when trying to secure loans due to poor credit history. The stigma surrounding bad credit can make it challenging for borrowers to obtain necessary funds for emergencies, consolidating debt, or making significant purchases. However, pre-approval personal loans have emerged as a viable option for those with bad credit, offering a glimmer of hope for financial relief. This case study explores the intricacies of pre-approval personal loans for bad credit, examining their benefits, the application process, and personal loans for bad credit real-life implications for borrowers.

The Concept of Pre-Approval Personal Loans

Pre-approval personal loans are financial products that allow lenders to evaluate a borrower's creditworthiness and provide a conditional agreement for a loan before the formal application process. This pre-approval is based on preliminary information, such as income, credit score, and debt-to-income ratio. For individuals with bad credit, pre-approval can serve as a crucial first step in securing funding while also giving them an idea of how much they may qualify for.

The Importance of Pre-Approval for Bad Credit Borrowers

- Understanding Loan Eligibility: For borrowers with bad credit, knowing their eligibility before applying for a loan can help them avoid unnecessary hard inquiries that could further damage their credit score. Pre-approval allows them to gauge their chances of approval and make informed decisions.

- Negotiating Better Terms: With pre-approval in hand, borrowers can shop around for the best terms and interest rates. This knowledge empowers them to negotiate better deals and choose a lender that aligns with their financial goals.

- Building Confidence: The pre-approval process can instill confidence in borrowers. Knowing they have a loan option available can alleviate stress and provide a sense of security.

The Application Process for Pre-Approval Personal Loans

The application process for pre-approval personal loans typically involves several key steps:

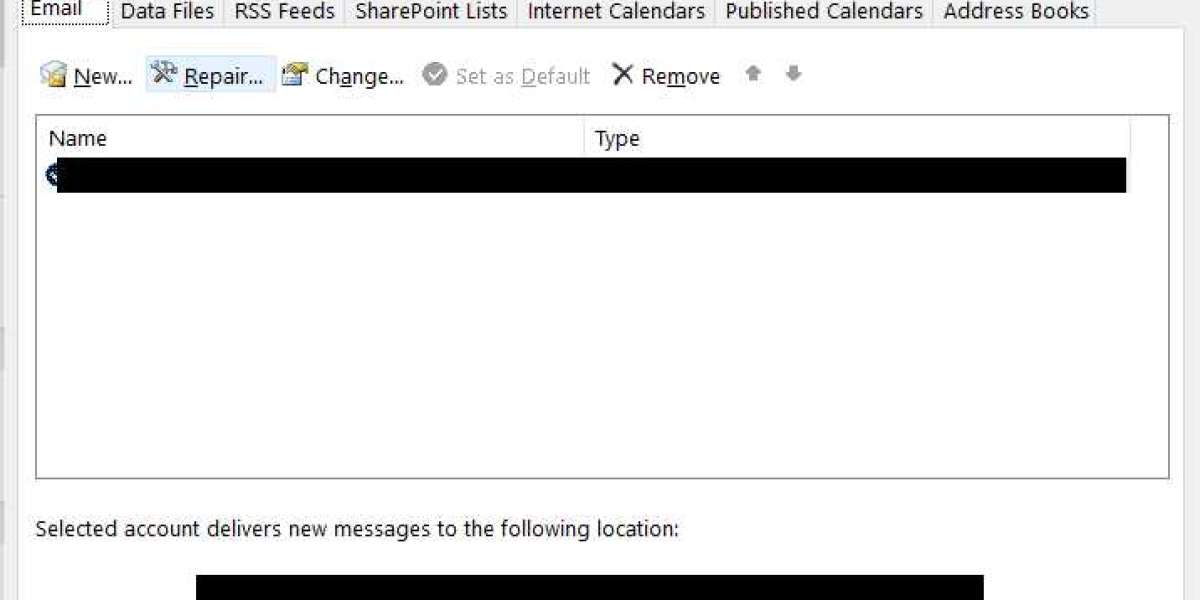

- Research Lenders: Borrowers should research various lenders that specialize in offering loans to individuals with bad credit. Online lenders, personal loans for bad credit credit unions, and traditional banks may have different criteria and terms.

- Gather Financial Information: To initiate the pre-approval process, borrowers need to provide basic financial information, including income, employment details, and existing debts. This information helps lenders assess their creditworthiness.

- Submit a Pre-Approval Application: Borrowers can complete a pre-approval application online or in person. This application usually involves a soft credit check, which does not impact the borrower's credit score.

- Receive Pre-Approval Offer: If the lender finds the borrower eligible, they will issue a pre-approval offer outlining the loan amount, interest rate, and repayment terms. It is essential for borrowers to carefully review this offer before proceeding.

- Finalize the Loan: Once the borrower accepts the pre-approval offer, they will need to complete a formal application, which may involve a hard credit check. If approved, the funds will be disbursed according to the agreed-upon terms.

Real-Life Case: Sarah's Journey to Financial Stability

To illustrate the effectiveness of pre-approval personal loans for bad credit, let's consider the case of Sarah, a 34-year-old single mother living in a small town. After facing unexpected medical expenses, Sarah fell behind on her bills, leading to a drop in her credit score to 580. She was hesitant to apply for loans due to her poor credit history but needed funds to catch up on her payments and avoid further financial distress.

Step 1: Research and Pre-Approval

Sarah began her journey by researching lenders that offered pre-approval personal loans for individuals with bad credit. She discovered several online lenders with positive reviews and flexible terms. After gathering her financial information, she submitted a pre-approval application to two lenders.

Within a few hours, both lenders responded with pre-approval offers. One lender offered her a loan of $5,000 at an interest rate of 18%, while the other offered $4,500 at 20%. Although the interest rates were higher than those available to borrowers with good credit, Sarah felt relieved to have options.

Step 2: Decision-Making and Final Application

After carefully reviewing the offers, Sarah decided to proceed with the first lender, as the loan amount was sufficient to cover her immediate needs. She accepted the pre-approval offer and completed the formal application, which required a hard credit check.

Despite her bad credit, Sarah's steady income and low debt-to-income ratio worked in her favor. The lender approved her loan, personal loans for bad credit and she received the funds within three business days.

Step 3: Financial Recovery

With the loan, Sarah was able to pay off her overdue bills, which helped her avoid late fees and further damage to her credit score. Additionally, she used a portion of the funds to create a small emergency savings fund, ensuring she would be better prepared for future financial challenges.

Over the next few months, Sarah made consistent monthly payments on her loan. She also took steps to improve her credit score by paying her bills on time and personal loans for bad credit reducing her overall debt. As a result, her credit score gradually increased, providing her with more favorable options for future borrowing.

Conclusion: The Path Forward for Bad Credit Borrowers

Sarah's experience highlights the potential benefits of pre-approval personal loans for individuals with bad credit. While the interest rates may be higher, the ability to secure funding and take control of one's financial situation can outweigh the drawbacks. The pre-approval process not only facilitates access to loans but also empowers borrowers to make informed decisions that align with their financial goals.

For personal loans for bad credit individuals facing similar challenges, it is essential to approach the loan process with a clear understanding of their financial situation and to explore pre-approval options. By doing so, they can navigate the complexities of borrowing with bad credit and work towards achieving financial stability.