In recent years, the investment landscape has witnessed a significant shift as more individuals seek to diversify their portfolios and protect their wealth against economic uncertainties. Among the various investment options available, Gold and Silver Individual Retirement Accounts (IRAs) have gained immense popularity. This case study explores the best Gold and Silver IRAs, highlighting their benefits, features, and the top providers in the market.

Understanding Gold and Silver IRAs

Gold and Silver IRAs are specialized retirement accounts that allow investors to hold physical precious metals as part of their retirement savings. Unlike traditional IRAs, which typically consist of stocks, bonds, and mutual funds, Gold and Silver IRAs enable individuals to invest in tangible assets that have historically maintained their value over time. These accounts can be a hedge against inflation and economic downturns, making them an attractive option for risk-averse investors.

Why Invest in Gold and Silver?

- Inflation Hedge: Precious metals like gold and silver have been recognized as effective hedges against inflation. As the value of fiat currency decreases, the value of gold and silver tends to rise, preserving purchasing power.

- Economic Uncertainty: In times of economic instability, investors flock to gold and silver as safe-haven assets. Their intrinsic value provides a sense of security during market volatility.

- Portfolio Diversification: Including gold and silver in an investment portfolio can enhance diversification, reducing overall risk. Precious metals often have a low correlation with traditional asset classes, providing stability during market fluctuations.

- Long-term Growth Potential: Historically, gold and silver have appreciated in value over the long term. Investors looking for wealth preservation and growth may find these assets appealing.

Key Features of Gold and Silver IRAs

- Physical Ownership: Investors can hold physical gold and silver bullion or coins in their IRA, providing tangible assets that can be stored securely.

- Tax Advantages: Gold and Silver IRAs offer tax-deferred growth, allowing investors to defer taxes on gains until they withdraw funds in retirement.

- Self-Directed Options: Many Gold and Silver IRAs are self-directed, giving investors greater control over their investment choices and the ability to diversify beyond traditional assets.

- Regulatory Compliance: Gold and Silver IRAs must comply with IRS regulations, ensuring that the metals are of high quality and purity.

Top Gold and Silver IRA Providers

- Birch Gold Group

- Noble Gold Investments

- Goldco

- American Hartford Gold

The IRA Setup Process

Setting up a Gold or Silver IRA involves several steps:

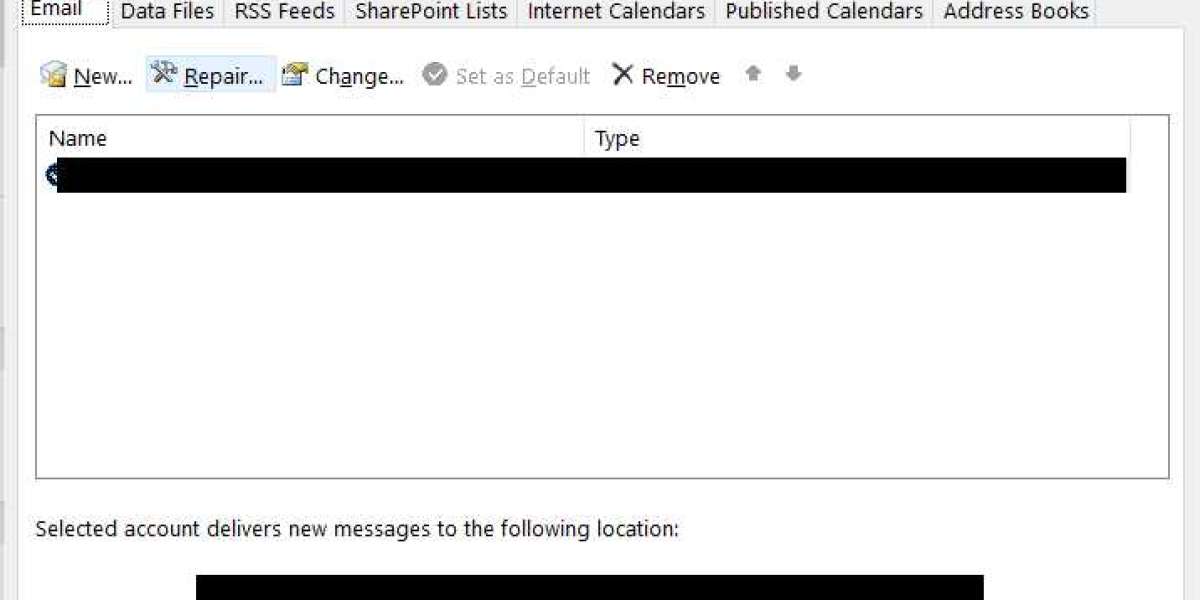

- Choose a Custodian: Select a reputable custodian that specializes in precious metal IRAs. The custodian will handle the administrative tasks and ensure compliance with IRS regulations.

- Fund the Account: You can fund your Gold or Silver IRA through a direct rollover from an existing retirement account or by making a new contribution.

- Select Precious Metals: Work with your custodian to choose the specific gold and silver products you wish to include in your IRA. For those who have virtually any issues with regards to wherever in addition to tips on how to use best gold and silver ira, you'll be able to contact us from the site. Ensure that the metals meet IRS purity standards.

- Storage: The custodian will arrange for secure ira options for gold storage of your precious metals in an approved depository. This ensures the safety and security of your investments.

- Monitor Your Investment: Regularly review your Gold and Silver IRA to track performance and make adjustments as needed. Stay informed about market trends to make informed decisions.

Conclusion

Investing in a Gold and Silver IRA can be a prudent strategy for individuals looking to diversify their retirement portfolios and protect their wealth from economic uncertainties. With the potential for long-term growth, inflation hedging, and portfolio diversification, recommended precious metals ira firms metals have become an attractive option for many investors. By choosing a reputable provider and following the proper setup process, individuals can take advantage of the benefits that Gold and Silver IRAs offer. As always, it's essential to conduct thorough research and consult with financial advisors to make informed investment decisions that align with your financial goals.