In recent times, the monetary landscape has been marked by volatility, prompting investors to hunt refuge in various assets. Among these, Gold Individual Retirement Accounts (IRAs) have emerged as a well-liked selection for those trying to diversify their retirement financial savings. This article explores the mechanics of Gold IRAs, their benefits, and the elements driving their increasing popularity.

Gold IRAs are a sort of self-directed retirement account that allows traders to carry physical gold and other precious metals as a part of their portfolio. In contrast to traditional IRAs, which typically encompass stocks, bonds, and mutual funds, Gold IRAs enable individuals to put money into tangible assets. This unique feature has attracted a rising number of buyers who're cautious of inflation and economic uncertainty.

One among the first benefits of a Gold IRA is its capability to act as a hedge towards inflation. Traditionally, gold has maintained its value over time, even throughout intervals of economic turmoil. As governments print extra money and interest rates remain low, many buyers worry that the buying energy of their cash financial savings will diminish. By investing in gold, they goal to preserve their wealth and safe their financial future.

Another benefit of Gold IRAs is the potential for tax advantages. Like traditional IRAs, contributions to a Gold IRA could also be tax-deductible, and the investment grows tax-deferred till retirement. This means that people can potentially cut back their taxable income whereas concurrently building a nest egg that features valuable metals. Additionally, when the account holder reaches retirement age, they'll withdraw funds with out incurring penalties, provided they follow the IRS guidelines.

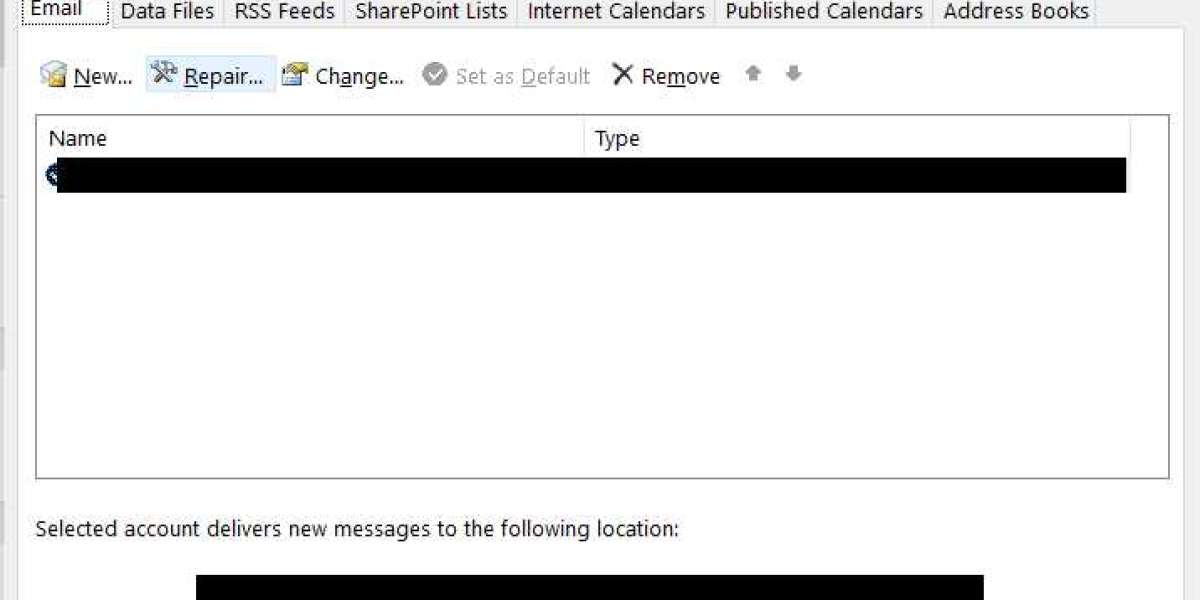

Establishing a Gold IRA is relatively simple, however it requires cautious consideration and planning. Buyers must first choose a custodian who makes a speciality of self-directed IRAs and has experience with precious metals. The custodian will handle the administrative duties, together with the acquisition and storage of the gold. It is essential to select a reputable custodian, as they will play a vital position in the management of the account.

Once the custodian is chosen, investors can fund their Gold IRA by way of quite a lot of strategies, including rollovers from existing retirement accounts or direct contributions. It is important to notice that the IRS has particular rules concerning the varieties of gold and other valuable metals that can be held in a Gold IRA. If you have any questions regarding where and how to use leading gold ira investment recommended firms for ira gold-backed rollover - eximiusproperties.ae,, you can get in touch with us at our webpage. Only bullion coins and bars that meet certain purity standards are eligible, and buyers must make sure that their purchases comply with these laws.

Storage is another crucial side of Gold IRAs. The IRS mandates that bodily gold should be stored in an accredited depository, which supplies safe storage and insurance for the treasured metals. Traders can not take possession of the gold themselves while it is held within the IRA, as this is able to set off tax penalties. Due to this fact, selecting a reliable options for retirement ira investments depository is important for guaranteeing the safety of the funding.

The increasing popularity of Gold IRAs can be attributed to a number of factors. First, the worldwide financial local weather has develop into more and more unsure, with rising inflation rates and geopolitical tensions inflicting concern amongst investors. Because of this, many people need to gold as a secure haven asset that can present stability during turbulent times.

Additionally, the COVID-19 pandemic has further highlighted the significance of diversifying investment portfolios. With traditional markets experiencing significant fluctuations, buyers are seeking different belongings that can withstand market downturns. Gold has historically performed properly throughout crises, making it a sexy possibility for those trying to safeguard their retirement savings.

Moreover, the rise of digital platforms and funding apps has made it easier for people to access Gold IRAs. Many companies now supply consumer-friendly interfaces that permit investors to arrange and manage their accounts online. This accessibility has contributed to the growing interest in Gold IRAs, particularly among younger traders who're eager to explore various funding choices.

Regardless of the benefits, potential buyers should also remember of the risks related to Gold IRAs. The price of gold can be unstable, and whereas it has historically maintained its worth, there are no ensures that it's going to continue to take action. Moreover, the costs associated with establishing and sustaining a Gold IRA, including custodian fees and storage fees, can eat into potential returns.

Moreover, investors should be cautious of scams and unscrupulous dealers in the gold market. It's crucial to conduct thorough analysis and due diligence before making any investments. Searching for advice from financial professionals who focus on valuable metals might help individuals navigate the complexities of Gold IRAs and make knowledgeable decisions.

In conclusion, Gold IRAs have gained traction as a viable investment possibility for those trying to diversify their retirement portfolios and protect their wealth from financial uncertainty. With their potential tax advantages, ability to hedge towards inflation, and growing accessibility, Gold IRAs current an appealing various to conventional retirement accounts. Nevertheless, traders must strategy this asset class with caution, carefully weighing the risks and conducting thorough research earlier than making any commitments. As more people search to safe their monetary futures, Gold IRAs are possible to stay a prominent fixture within the funding landscape for years to come back.